Illinois currently has a flat tax system, where everyone pays the same income tax rate of 4.95%. On November 3rd, 2020, Illinois voters will have a once-in-generation opportunity to amend the state constitution to create a Fair Tax.

What is the Fair Tax?

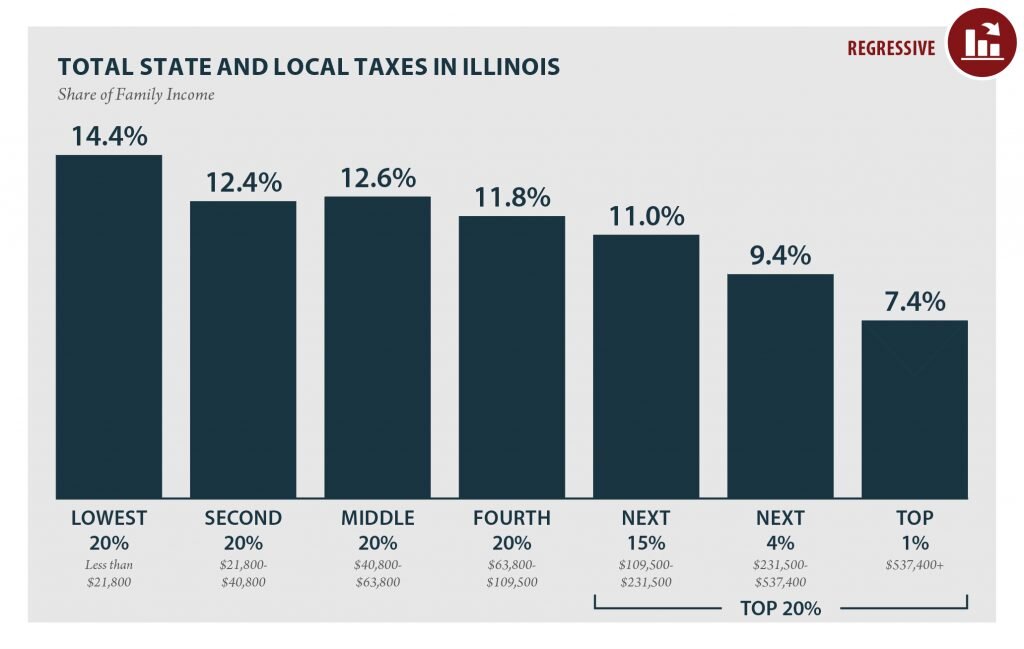

Illinois’ current tax system is upside down. Low income households pay twice as much of their income in taxes as the wealthiest 1% (see the chart below). This upside down tax system extracts money from working class people while allowing the rich to avoid paying their fair share. Our current tax system takes already extreme economic inequality and makes it worse. The Fair Tax will make those with higher incomes pay higher rates, so that the rich can start paying their fair share of taxes.

Why do we need the Fair Tax?

The current system is not only unfair, it also fails to fund state government, forcing a combination of cuts to public services and borrowing at high rates. The Fair Tax would generate $3.4 billion in new revenue annually, which could be invested in education, housing, social services, and other programs that will allow all Illinois communities to thrive.

But will my taxes go up?

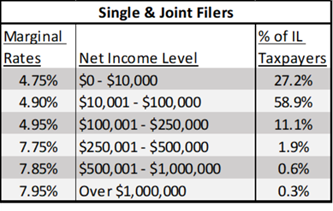

For 97% of Illinoisans, your taxes will stay the same or go down. Only people with incomes higher than $250K/year will see a tax increase.

What’s the rate structure?

See the chart to the right for details on the

rate structure. This rate structure has already been voted on by the Illinois General Assembly and will automatically take effect if the ballot referendum passes. Please note that the corporate income tax rate will increase from 7% to 7.99%.

How does this rate structure compare to other states in the Midwest?

Iowa, Minnesota, Missouri, and Wisconsin all have a graduated income tax. The following marginal tax rates represent the lowest rate to the highest rate in each state.

Iowa: 0.33-8.53%

Minnesota: 5.35-9.85%

Missouri: 1.5-5.4%

Wisconsin: 4.0-7.65%